Yellowstone County Property Ownership

Yellowstone County Fiscal Year 2026 Final Budget Summary

Fiscal year 2026 revenues from all sources (including internal transfers) are budgeted at $155 million, of which $74.5 million is derived ...

https://www.yellowstonecountymt.gov/Finance/Budget/budget26/NarrativeFY26.pdfAs... - Forrester Group Real Estate - eXp Realty of Montana Facebook

As of 1/13/2026, there are 506 residential homes on the market in Yellowstone County and an estimated 1,300 total Agents in the Billings MLS. Low inventory. High competition. A lot of REALTORS are chasing fewer opportunities. So how do the successful agents still win? Here's your FREE Guide....

https://www.facebook.com/ForresterGroupRealEstate/posts/as-of-1132026-there-are-506-residential-homes-on-the-market-in-yellowstone-count/1521965962834072/

Tax Relief for Homesteads and Long-term Rentals

Under Montana Law (15-1-802, MCA) all tax payments equal to or greater than $50,000 must be made electronically starting January 1, 2026. Tax Relief for Homesteads and Long-term Rentals See if you qualify today Below is a summary of changes to Montana's Property laws for "homesteads" and long-term rentals.

https://revenue.mt.gov/property/property-tax-changes/homesteads-and-long-term-rentals

Treasurer

Yellowstone CountyTREASURER Tax Due Dates November 30th May 31st June 30th May 31st (2025 ONLY: June 30th) November 30th All Taxes are due by 5 PM Mountain Time on their due date by State Law. If the due date falls on a weekend or a holiday, the next business day will be the due date Hank Peters, serving as Treasurer, Assessor, and Superintendent of Schools, plays a pivotal role in...

https://www.yellowstonecountymt.gov/Treasurer/

Access to this page has been denied

Learn more about the Yellowstone County housing market and real estate trends ... 2006 to 2026 Zillow 2006-2026 Zillow Equal Housing Opportunity. Footer art.

https://www.zillow.com/home-values/3149/yellowstone-county-mt/Treasurer: Yellowstone County taxpayers could be on hook ...

Yellowstone County property owners could see an increase on their property taxes ... 2026 and 2027. Christman said the issue caught him by surprise. "I feel bad ...

https://www.ktvq.com/news/local-news/treasurer-yellowstone-county-taxpayers-could-be-on-hook-for-schools-shortfallConsolidated Yellowstone County Zoning Commission meeting of Thursday, January 8, 2026 Billings Planning & Community Services Department Facebook

Consolidated Yellowstone County Zoning Commission meeting of Thursday, January 8, 2026...

https://www.facebook.com/BillingsCityCountyPlanning/videos/consolidated-yellowstone-county-zoning-commission-meeting-of-thursday-january-8-/1601467217757948/

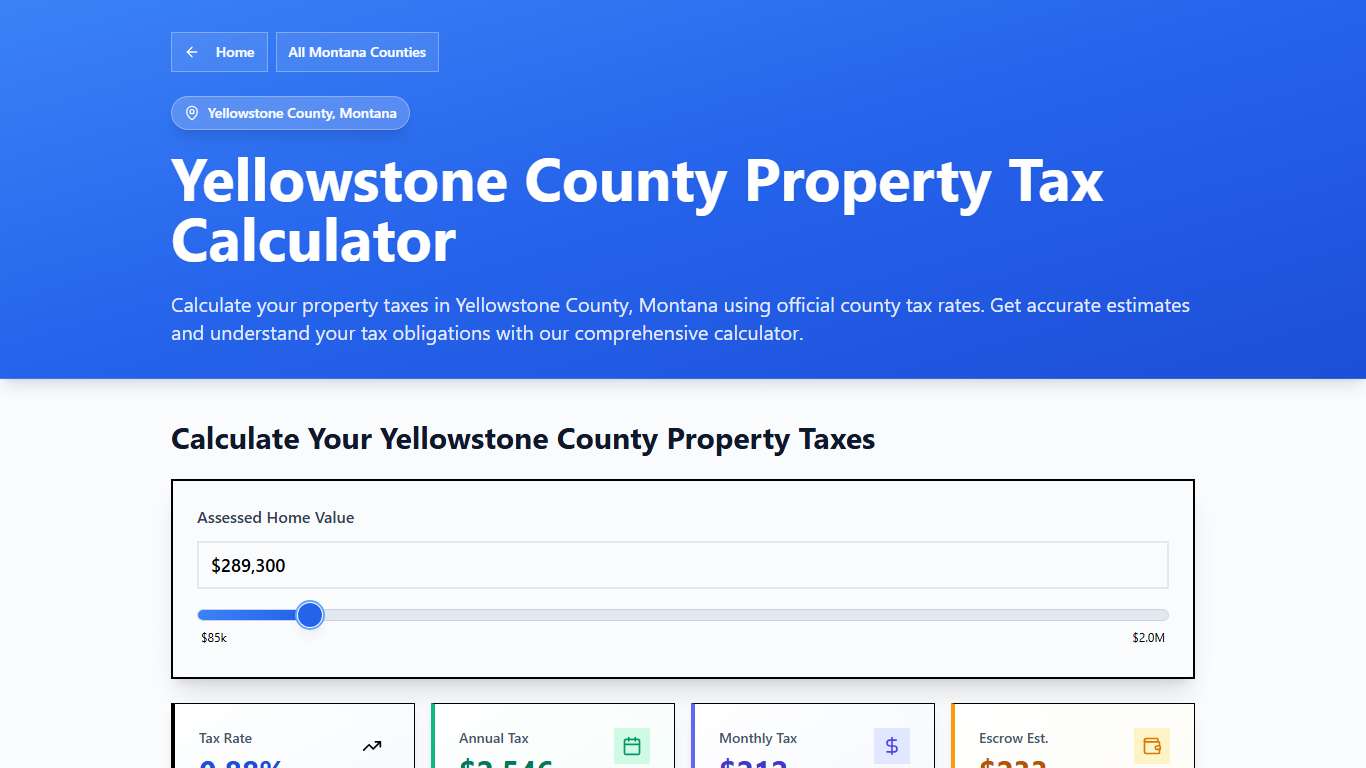

Yellowstone County, MT Property Tax Calculator 2025-2026

Calculate Your Yellowstone County Property Taxes Yellowstone County Tax Information How are Property Taxes Calculated in Yellowstone County? Property taxes in Yellowstone County, Montana are calculated based on your property's assessed value multiplied by the local tax rate. The county's effective tax rate of 0.88% is applied to determine your annual property tax obligation.

https://propertytaxescalculator.com/montana/yellowstone-county

Consolidated Yellowstone County Zoning Commission meeting of Thursday, January 8, 2026 Billings Planning & Community Services Department Facebook

Consolidated Yellowstone County Zoning Commission meeting of Thursday, January 8, 2026...

https://www.facebook.com/BillingsCityCountyPlanning/videos/consolidated-yellowstone-county-zoning-commission-meeting-of-thursday-january-8-/1601467217757948/

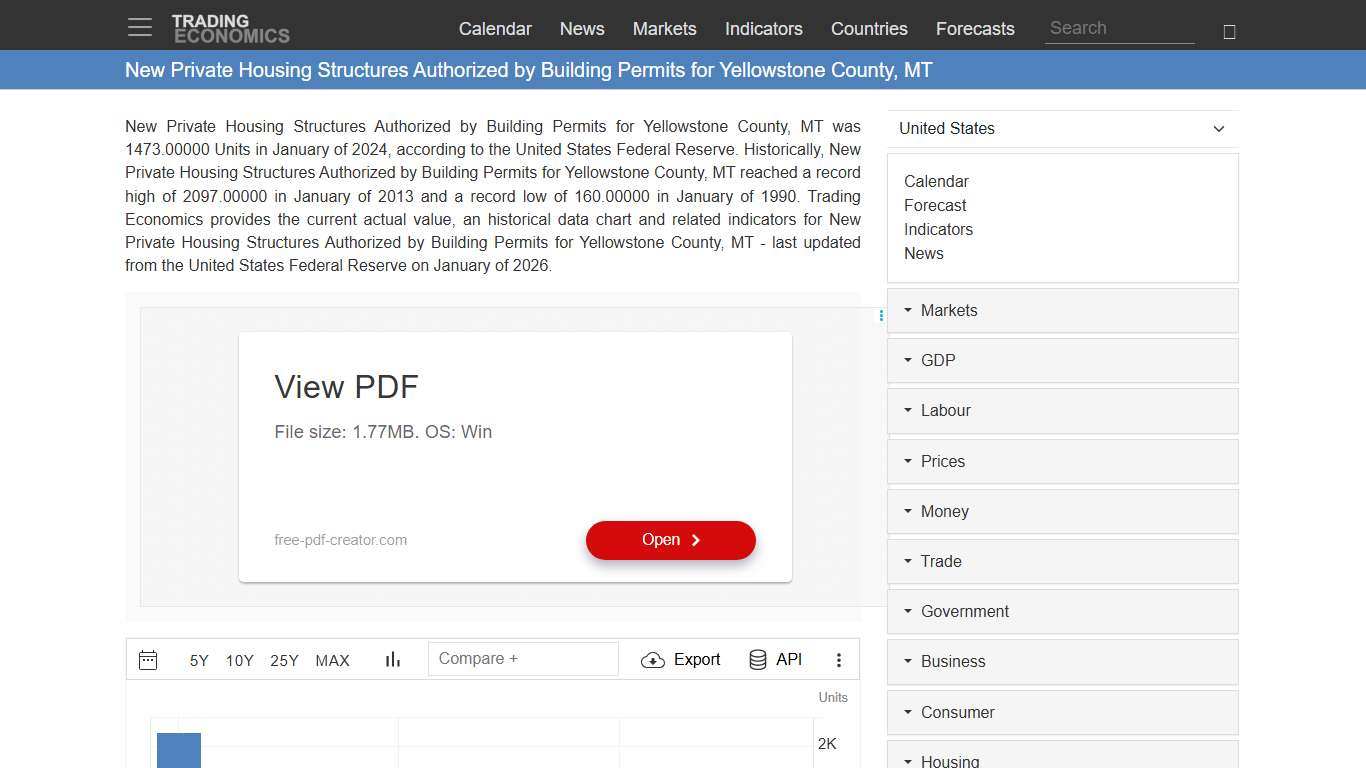

New Private Housing Structures Authorized by Building Permits for Yellowstone County, MT - 2026 Data 2027 Forecast 1990-2024 Historical

New Private Housing Structures Authorized by Building Permits for Yellowstone County, MT was 1473.00000 Units in January of 2024, according to the United States Federal Reserve. Historically, New Private Housing Structures Authorized by Building Permits for Yellowstone County, MT reached a record high of 2097.00000 in January of 2013 and a record low of 160.00000 in January of 1990.

https://tradingeconomics.com/united-states/new-private-housing-structures-authorized-by-building-permits-for-yellowstone-county-mt-fed-data.html

Property Assessment

Property Assessment Property Valuation News For the 2025-2026 property valuation cycle, all real property is valued as of January 1, 2024. Montana law specifically requires that all real property be valued on the same day every two years so that tax burdens are equally distributed among all taxpayers across the state.

https://revenue.mt.gov/property/

Christi Jacobsen - Montana Secretary of State - Official Montana Secretary of State Website - Christi Jacobsen

Secretary of State Christi Jacobsen announced a new statewide campaign to recruit poll workers for the 2026 Primary and General Elections, continuing her efforts to support county election offices and strengthen Montana’s election workforce. Welcome to the official website 321,000+ Business Registrations 769,000+ Registered Voters — Thank you for doing business in Montana!

https://sosmt.gov/

Treasurer

TreasurerDelinquent Property Tax Information Access detailed property records, current assessed values, and tax information quickly and securely. Our goal is to provide transparent, up-to-date data to help property owners, buyers, and the public make informed decisions. Tax ID: A01196 Penalty and Interest calculated as of 1/19/2026 Contact the Yellowstone County Treasurer's Office, (406) 256-2802, for complete payoff information.

https://www.yellowstonecountymt.gov/treasurer/propertysearch/csadelin.asp?propid=A01196&pidate=1/19/2026